ICT Balanced Price Range – ICT BPR

Are you looking to master the ICT balanced price range (BPR) to trade accurately?

Well, in this blog post we will teach you all about ICT balanced price range (BPR) from its identification to its use with real market examples.

Now lets begin with defining the ICT balanced price range.

What is ICT Balanced Price Range (BPR)?

ICT balanced price range is a concept based on ICT Fair Value Gap. To understand ICT balanced price range you are recommended to go through ICT Fair Value Gap.

ICT Balanced price range (BPR) is the area on price chart where two opposite fair value gaps overlap.

How to Identify ICT Balanced Price Range (BPR)?

To identify the balanced price range (BPR) you have to mark the a fair value gap on the sell side of price and another fair value gap on the buy side of the price.

Both fair value gaps being horizontally opposite to each other.

Now find and mark the area of price where both fair value gaps overlap with each other.

The area of overlapping of two fair value gaps is called balanced price range.

Why Balanced Price Range is Important?

ICT balanced price range (BPR) is important because of its sensitivity to the price.

When price approaches the ICT balanced price range (BPR) it will give a quick reaction as a strong move.

This is because its the combination of two fair value gaps and being a good point of interest for smart money traders.

Bullish ICT Balanced Price Range

Bullish ICT balanced price range is identified on the buy side of price and is used by traders to initiate buy trades.

To Trade a Bullish ICT BPR you have to look for bullish market structure and a bullish PD Array.

When price approaches the bullish PD array look for the ICT Market Structure Shift in lower time frame.

After the market structure shift, identify a bullish fair value gap in Discount Zone which is overlapping with a bearish fair value gap.

Now mark the area of overlapping and wait for price to test that area to execute a buy trade.

Or you can use a buy limit too, with stop loss below the recent swing low and for profit target you may look for higher time frame draw on liquidity.

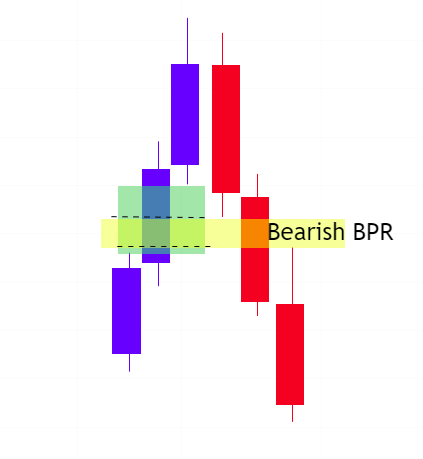

Bearish ICT Balanced Price Range

Bearish ICT balanced price range is identified on the sell side of price and is used by traders to initiate sell trades.

To Trade a Bearish ICT BPR you have to look for bearish market structure and a bearish PD Array.

When price tests the bearish PD array look for the ICT Market Structure Shift in lower time frame.

After the market structure shift, identify a bearish fair value gap in Discount Zone which is overlapping with a bullish fair value gap opposite to it.

Now mark the area of overlapping and you can execute a sell trade when price tests that area.

Or you can use a sell limit too, with stop loss above the recent swing high and for profit target you may look for higher time frame draw on liquidity.

Is ICT Balanced Price Range Reliable for Trading?

Absolutely Yes! ICT balanced price range is the most reliable concept for trading if used in discount area for bullish trade setup and in premium area for bearish trade setups.

Can ICT BPR be Used for Scalping?

Yes balanced price range can be be used for scalping, day trading and swing trading as well.

You just have to look for it in lower time frames like M1 and M3 or M5 for scalping.

ICT BPR vs ICT FVG

ICT fair value gap is a 3 candle formation with a gap between 1st and 3rd candle retracement and is used for entering a trade also.

While balanced price range is also a fair value gap but its combination of two FVGs and it is also used for executing trades.