ICT One Shot One Kill Trading Model

Do you want to master ICT one shot one kill trading model like a pro to level up your trading?

In this blog post we will teach you all about ICT one shot one kill trading model from its formation to its identification and to its use along with real market examples.

Lets start with defining the ICT one shot one kill trading model.

What is ICT One Shot One Kill Trading Model

ICT one shot one kill trading model is basically a 50/75 pips per week trading plan.

In this model we look for the weekly bias and next draw on liquidity in weekly chart and then wait for a high impact economical data like FOMC or NFP to sweep the liquidity and grab that opportunity.

To master ICT one shot one kill trading model you have to follow 5 steps explained below.

(I) Preparation

Note all medium and high impact economical events for the market you are following.

Study the economical events on the week to come and consider how the current market structure and the economic events may suggest the specific weekly profile for that weeks range.

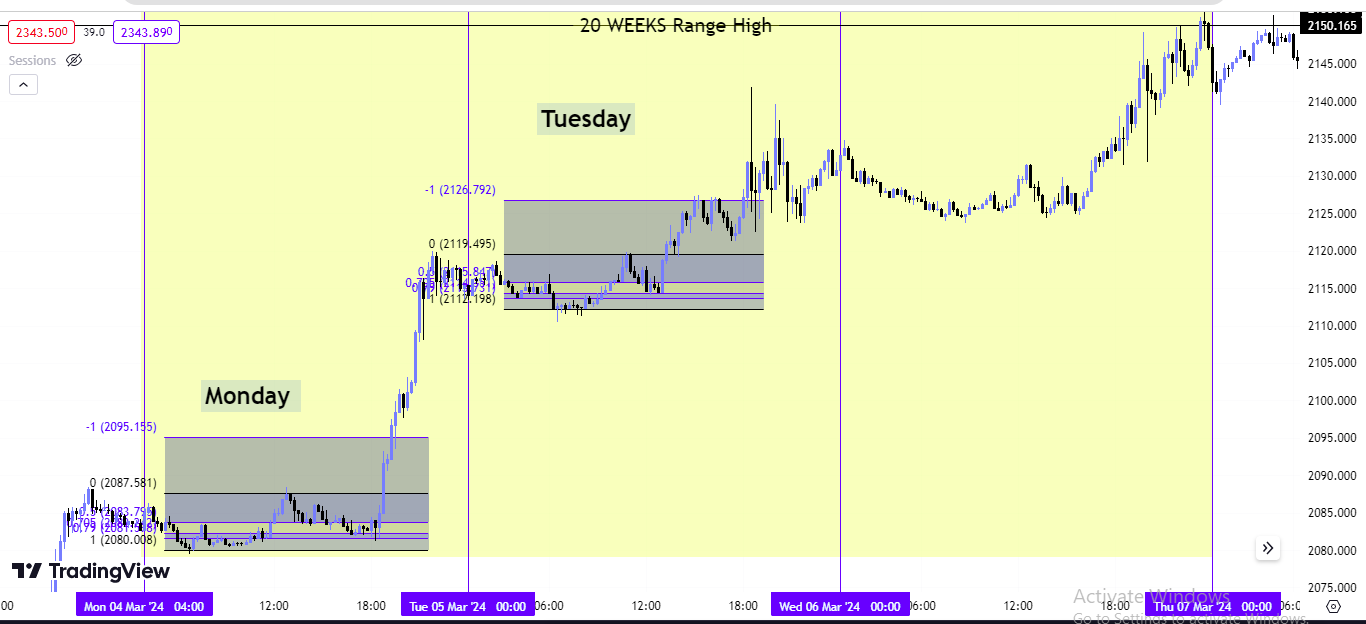

Now go to the weekly chart and determine the IPDA data range of last 20 weeks.

Mark the highest high and lowest low of past 20 weeks. This will be your current dealing range.

Inside the dealing range look for the next draw on liquidity. Where price is likely to trade to next, below which old low, above which old high.

Then you have to look for ICT PD Array in the direction of weekly range bias.

We anticipate the price to move to our PD array in next trading week.

This volatility injection is what we wait for. This would be a run based on a low resistance liquidity run conditions.

(II) Opportunity Discovery

We look for 50 to 75 pips range that would enable a run to Buy Side Liquidity when bullish institutional order flow is present.

Or target the Sell Side Liquidity when bearish institutional order flow is present.

(III) Trade Planning

When the market is poised to decline we want to look for convergence of both manipulation in price, opposite to our weekly bias, at a time the economic calendar suggests volatility injection will likely unfold.

We will look for premium buy side liquidity to execute a sell trade.

(IV) Trade Execution

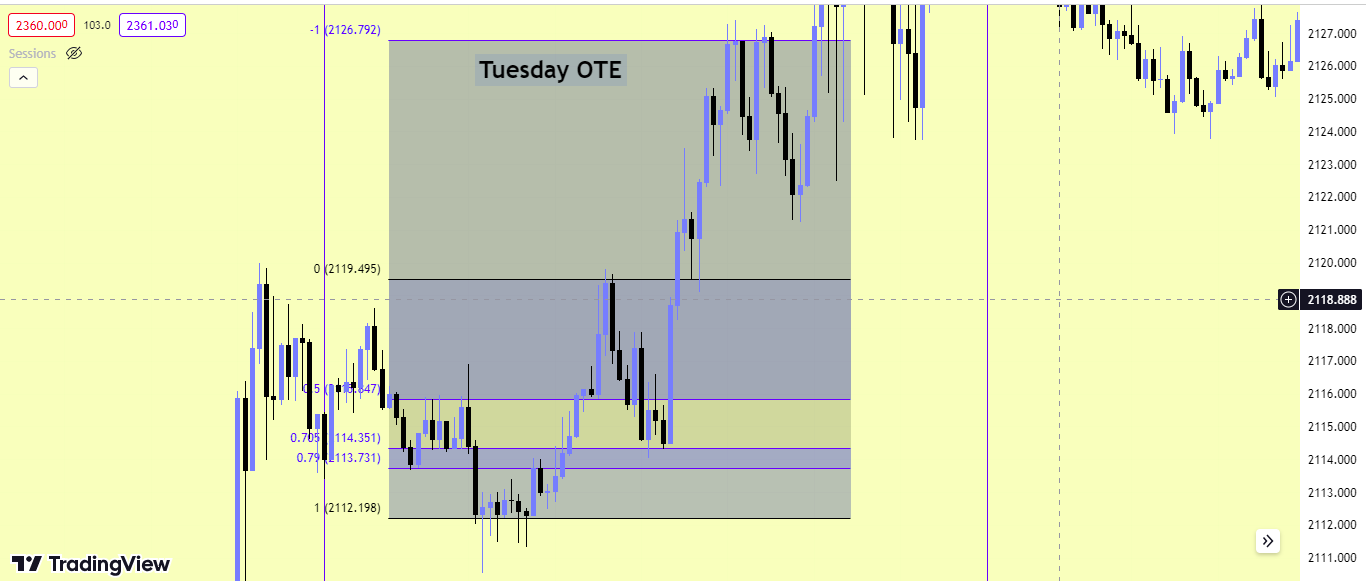

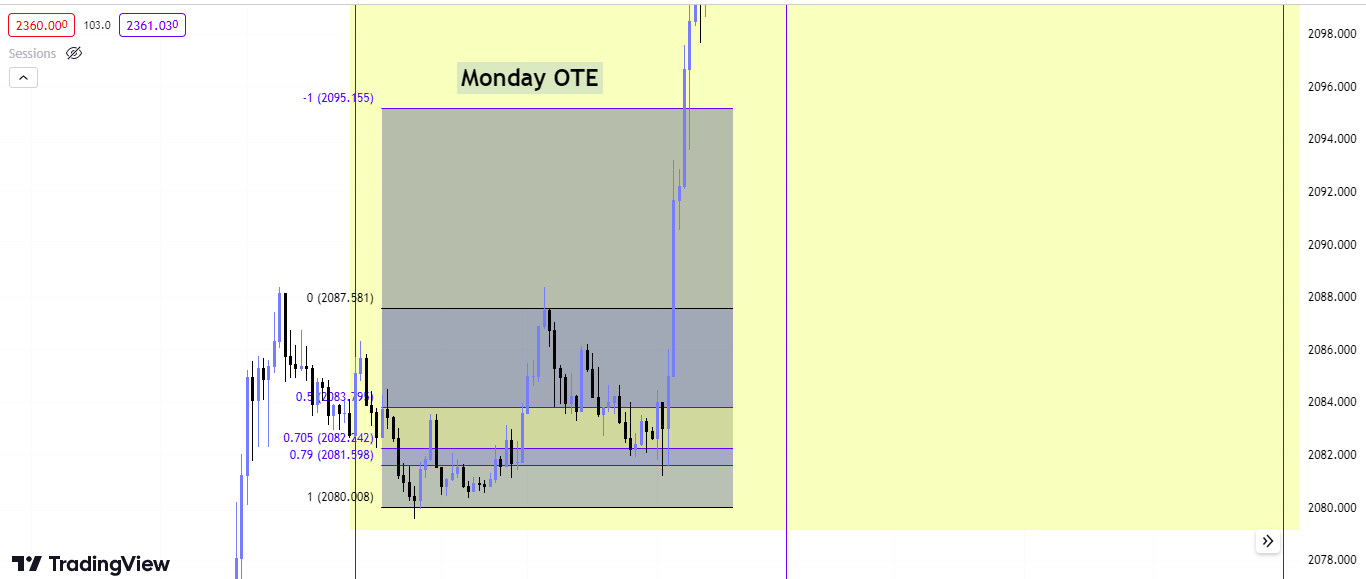

When our bias is bearish, we will anticipate a 15 minute chart *optimal trade entry* to form inside of a bullish retracement toward the bearish PD array during London open or New York open Kill Zone.

Or we will look for a buy stop raid to take a sell trade.

Trade Management

When we are entering a trade, we will place a limit order to take 50 pips as our objective on a single position.

We will use one order to manage the trade idea.

If you capture 50 pips close 80% of the position and see if the remainder can reach 75% partials.

Which Day to Expect for Trade Setup Formation?

Expect an anchor point to form on a Monday, Tuesday or Wednesday in order to frame a trade setup.

Is ICT One Shot Kill Model a Reliable Trading Model?

Yes ICT one shot one kill is the most reliable trading model and its suitable for those who can not sit and watch market daily or all the day so they can just mark the 20 weeks range and look for setup formation in first 3 days of week.

Can ICT One Shot One Kill Strategy Profit Target Go Beyond 75 Pips?

75 pips is just recommended and the easily achievable target.

Otherwise you can trail your trade up to 100 pips and more.

Or you can use ICT Fibonacci Levels to set your profit target.