ICT Daily Bias Explained in Depth

Do you want to master ICT daily bias to trade like a pro?

To trade using ICT strategy you need to have a correct daily bias. So daily bias is a key to ICT trading strategy.

ICT Daily bias is basically the assumed direction of the day like is it gonna be a bullish day or bearish day.

In this article we will be exploring the ICT daily bias from its definition to identification and to its use.

Now lets start with defining the ICT daily bias.

What is ICT Daily Bias?

In trading, the term “ICT daily bias” refers to the anticipated direction of daily price movements.

To effectively implement an ICT trading strategy, it’s crucial to accurately predict this daily bias in order to achieve a consistent winning streak.

How to Identify ICT Daily Bias?

To identify correct daily bias you need to check following elements.

(I) Daily timeframe order flow : It is a key element for identifying the ICT daily bias.

According to Michle Hudleston banks and institutional traders mostly utilize the daily chart to execute their orders effectively.

(II) Any Imbalance to rebalance : As you know price moves for two reasons and one of that is to balance the imbalance.

You have to look for the imbalance because price may go up or down to balance the imbalance.

(III) Draw on Liquidity : Second reason of price movement is to hunt the liquidity.

So you have to identify the next draw on liquidity like old highs or lows because price mostly tends sweep the liquidity levels.

How to Identify Daily Timeframe Order Flow?

Order flow is the current structure of price movement.

Bullish order flow means prices are expected to move higher.

When order flow is bullish prices make higher highs and higher lows.

Price moves up to take liquidity or balance the imbalance in price.

In a bullish market you look for buy trades and your daily bias will be pointed higher.

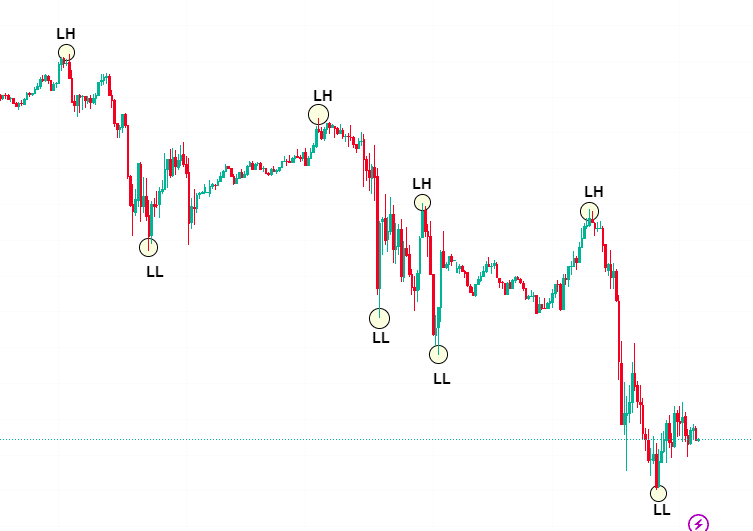

Bearish order flow indicates an expectation for prices to decrease.

In a bearish scenario, the order flow leads to lower lows and lower highs in price movement.

This downward momentum typically occurs as prices seek to access liquidity or rectify imbalances in the market.

Consequently, in a bearish market environment, your daily bias would be oriented towards anticipating further downward movement.

Bullish Daily Bias

Bullish daily bias means the anticipated price movement is toward the upside.

That may be because of the bullish order flow or the next draw on liquidity to the upside.

After finding the correct daily bias you have to mark your point of interest that could be an order block, breaker block, fair value gap or unicorn.

Now for trade execution you have to jump to lower time frame like 15 minutes or 30 minutes.

Wait for price to test you point of interest and seek for entry confirmation like market structure shift.

After confirmation you can execute a buy trade targeting daily timeframe draw on liquidity or imbalance.

A real market example is shown below.

Bearish Daily Bias

A bearish daily bias indicates an expectation for prices to decline.

This anticipation could come from a bearish order flow or the upcoming draw of liquidity towards the downside.

Once you establish the correct daily bias, it’s essential to identify key points of interest such as order blocks, breaker blocks, fair value gaps, or unicorns.

For trade execution, transitioning to lower time frames like 15 minutes or 30 minutes is necessary.

Here, you patiently wait for the price to test your identified points of interest, looking for confirmation such as a shift in market structure.

Upon confirmation, you can initiate a sell trade, aiming to capitalize on the draw of liquidity or imbalance observed on the daily timeframe.

A real market example illustrates this strategy in action.

Final Thoughts

For precise and correct daily bias you have to use ICT concepts like ICT PD Array ,ICT OTE Pattern and ICT Power of 3 in conjunction with daily time frame draw on liquidity and imabalance.

very very valuable lesson

thank u very much

Thanks for your kind words.