ICT SMT Divergence – Smart Money Technique

Mastering all ICT concepts is essential for trading using the ICT strategy. Among these crucial concepts is ICT SMT divergence which play a significant role in trade execution.

ICT SMT divergence is a smart money technique to identify key reversal point in financial markets using two correlated assets.

In this article we will teach you comprehensively on ICT SMT divergence covering its definitions, identification, and practical application through visual examples.

Now lets start with defining ICT SMT divergence.

What is ICT SMT Divergence?

As we discussed above ICT SMT divergence is a smart money tool to identify reversal points in financial markets and it is found in correlated assets.

Mostly the financial markets move symmetrically , means if two assets are negatively correlated and one makes a higher high then other correlated asset will be making a lower low.

But sometime the negatively correlated assets are seen diverging from each other.

If one makes a higher high the second asset fails to make a lower low and vice versa, which is termed as SMT divergence.

For better understanding we will be dividing it into two types.

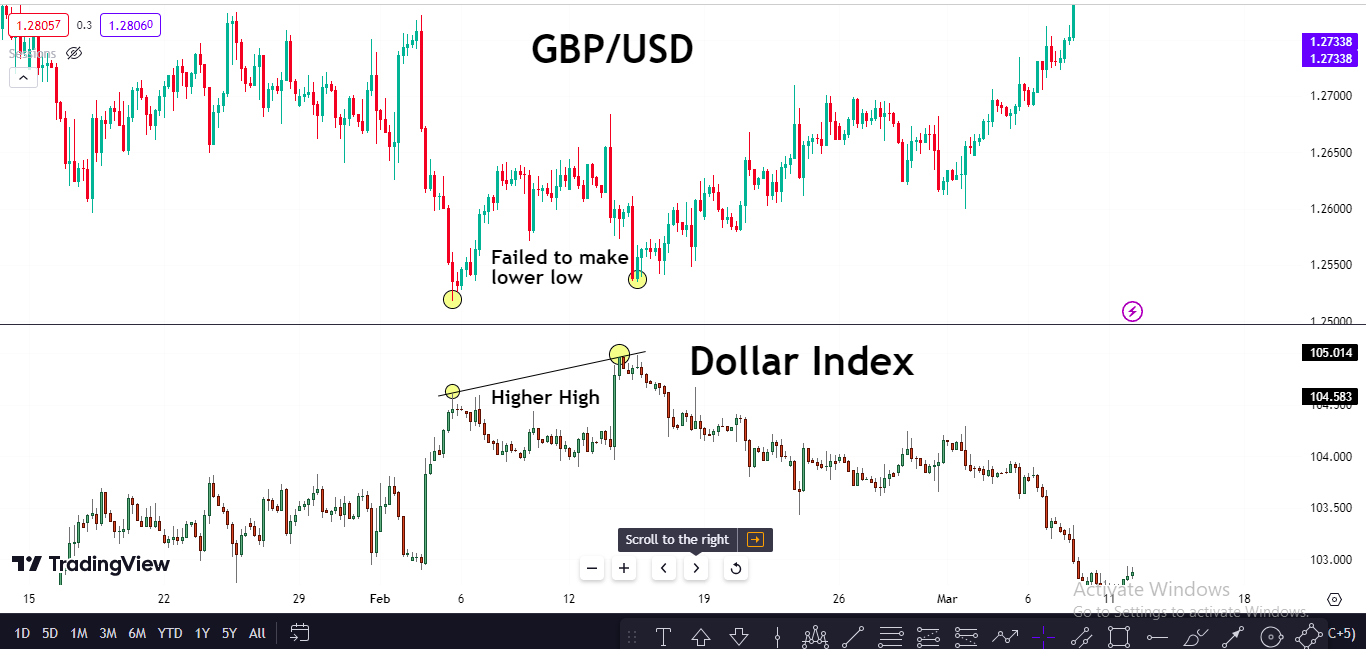

(I) Bullish SMT Divergence is identifiable between two negatively correlated assets.

When one asset makes a higher high but the second assets fails to make a lower low its called bullish SMT divergence.

It depicts the idea that the higher high formed in one asset is just a fake high to manipulate retail traders.

And the second asset which failed to make a lower low (in correlation to first asset) looks strong and is expected to move higher.

So you can plan a buy trade in the second asset using other ICT trade confirmations like Market Structure Shift or OTE Pattern.

A real market example is shown below.

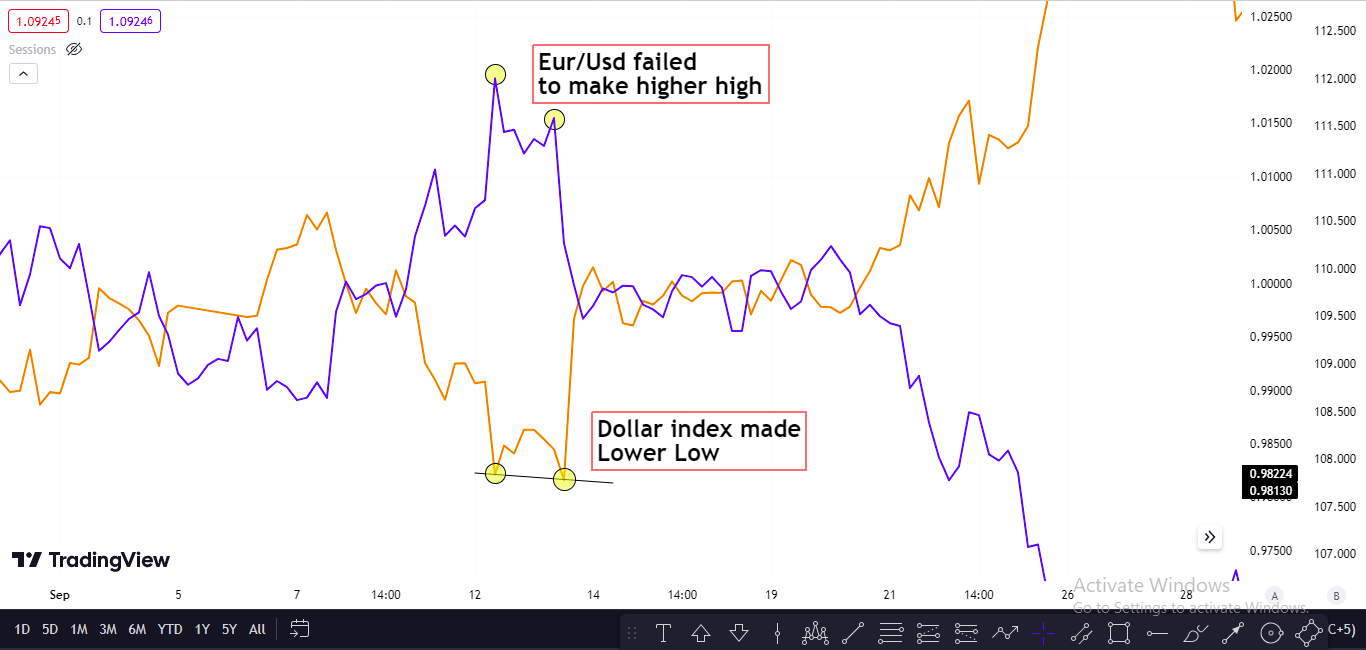

(II) Bearish SMT Divergence is also found in two negatively correlated assets.

When one asset makes a lower low but the second assets fails to make a higher high its called bearish SMT divergence.

It depicts the idea that the lower low formed in one asset is just a fake move to manipulate retail traders.

And the second asset which failed to make a higher high (in correlation to first asset) looks weak and is expected to move lower.

So you can plan a sell trade in the second asset using other ICT trade confirmations like Market Structure Shift or OTE Pattern

A real market example is shown below.

How to Trade using ICT SMT Divergence?

ICT SMT divergence can be a useful tool for trade execution.

You may use it with ICT PD Array at key levels like session highs/lows or daily highs/lows to execute a trade.

Final Thoughts

While trading using ICT SMT divergence we should keep in mind that every SMT divergence is not tradeable , to trade using SMT, we should use it in conjugation with other strategies like demand & supply or support & resistance . At these levels SMT divergence can act as a more reliable tool to take a trade.

Plus to mitigate your risks, you should always trade with stop loss in place as no strategy is fool proof in trading.