ICT Weekly Range Profiles

This blog post will guide you through the ICT weekly range profiles, covering their definition, identification, and use in trading with real market examples.

By studying this post thoroughly and practicing in real markets, you’ll gain the skills to trade ICT weekly range profiles like a professional.

Now lets start with defining the ICT weekly range profiles.

What is ICT Weekly Range Profiles?

ICT weekly range profiles are conceptual frameworks that describe typical patterns of price behavior during a trading week.

Each ICT weekly range profile has unique characteristics that can hint the traders in anticipating potential market movements.

However, it is important to note that these profiles are not fix predictions but rather frameworks to understand market tendencies.

Each ICT weekly range profile is explained below with examples.

(I) Classic Tuesday Low of the Week

Bullish Profile : When price is bullish it may manipulate on Monday and hover above a higher a higher time frame discount array.

Then on Tuesday it drops into higher time frame discount array to form low of the week.

To anticipate all this phenomenon you should know the higher time frame discount array.

When the market fails to drop into the discount array on Monday then its most likely that Tuesday will se the drive lower to mark weekly low in London or New York session.

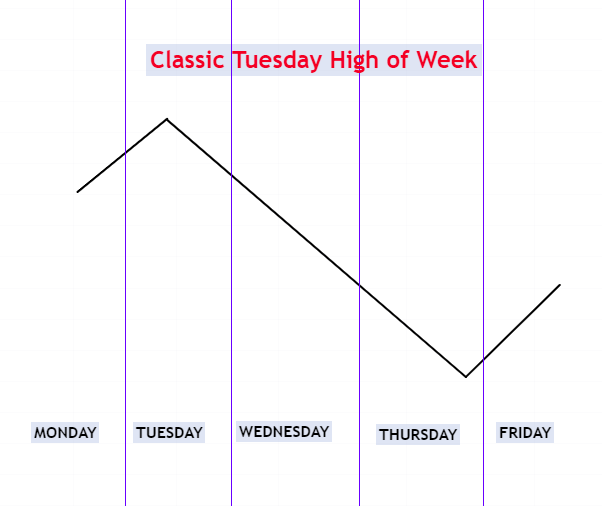

(II) Classic Tuesday High of the Week

Bearish Profile : When price is bearish it may manipulate on Monday and hover below a higher a higher time frame premium, array.

Then on Tuesday it rises into higher time frame premium array to form high of the week.

To anticipate all this phenomenon you should know the higher time frame Premium array.

When the market fails to rise into the premium array on Monday then its most likely that Tuesday will se the drive higher to mark weekly high in London or New York session.

(III) Wednesday Low of the Week

Bullish Profile : When price is bullish it may manipulate on monday and tuesday and hover above a higher a higher time frame discount array.

Then on wednesday it drops into higher time frame discount array to form low of the week.

To anticipate all this phenomenon you should know the higher time frame Discount Array

When the market fails to drop into the discount array on Monday and Tuesday then its most likely that Wednesday will se the drive lower to mark weekly low in London or New York session.

(IV) Wednesday High of the Week

Bearish Profile : When price is bearish it may manipulate on monday and tuesday and hover below a higher a higher time frame premium array.

Then on wednesday it rises into higher time frame premium array to form high of the week.

To anticipate all this phenomenon you should know the higher time frame premum array.

When the market fails to rise into the premium array on monday and tuesday then its most likely that wednesday will se the drive higher to mark weekly high in London or New York session.

(V) Consolidation Thursday Bullish Reversal

When price is bullish it may consolidate on monday through wednesday then runs the intra-week low and rejects it forming a market reversal.

To anticipate this you must know the higher timeframe discount array.

And when price fails to drop into higher timeframe discount array then its likely that thursday will see drive lower on market driver news or interest rate release late New York session around 02:00 PM (New York local time).

(VI) Consolidation Thursday Bearish Reversal

When price is bearish it may consolidate on monday through wednesday then runs the intra-week high and rejects it forming a market reversal.

To anticipate this you must know the higher timeframe premium array.

And when price fails to rise into higher timeframe premium array then its likely that thursday will see drive higher on market driver news or interest rate release late New York session around 02:00 PM (New York local time).

(VII) Consolidation Midweek Rally

Bullish Profile : When price is bullish and consolidates monday through wednesday then runs into intra-week high and expands higher into friday.

How to Anticipate?

When the price is bullish and has yet to run to premium array on the higher timeframe and it has recently rallied from a discount array and simply paused without any bearish reversal price action.

This indicates price is about to expand higher for the premium array.

(VIII) Consolidation Midweek Decline

Bearish Profile : When price is bearish and consolidates monday through wednesday then runs into intra-week low and expands lower into friday.

How to Anticipate?

When the price is bearish and has yet to run to discount array on the higher timeframe and it has recently declined from a premium array and simply paused without any bullish reversal price action.

This indicates price is about to expand lower for the premium array.

(IX) Seek and Destroy Bullish Friday

Neutral-Low Probability Profile When price consolidates monday through thursday running shallow stops under and above intra-week high, then runs the intra-week high and expands higher into friday.

How to Anticipate?

When market is awaiting interest rate announcements or Non-Farm payroll, it can create this profile in the summer months of July and august.

Better to avoid trading in these conditions.

(X) Seek and Destroy Bearish Friday

Neutral-Low Probability Profile When price consolidates monday through thursday running shallow stops under and above intra-week high, then runs the intra-week low and expands lower into friday.

How to Anticipate?

When market is awaiting interest rate announcements or Non-Farm payroll, it can create this profile in the summer months of July and august.

Better to avoid trading in these conditions.

(XI) Wednesday Weekly Bullish Reversal

When price is bullish and consolidates monday through tuesday and drives lower into higher timeframe discount array on wednesday to induce sell stops and then strongly reverses.

When the market is trading at the long term or intermediate term low, price will pair institutional buying with pending sell side liquidity (sell stops raid).

(XII) Wednesday Weekly Bearish Reversal

When price is bearish and consolidates monday through tuesday and drives higher into higher timeframe premium array on wednesday to induce buy stops and then strongly reverses.

When the market is trading at the long term or intermediate term high, price will pair institutional selling with pending buy side liquidity (buy stops raid).

Sir mery kch Questions wagera thay ICT or SMC ko ly ky agr ap mery questions ka jawab dy gy tou bohat mehbani hogi.

Yes sure, let me know your any question regarding ICT, SMC or related to forex. I will try to guide you to best of my knowledge.

Sb ys phly tou ya ky me kai dafa market me dekha hai ky ICT or SMC Trader Ki Condition ky mutabik koi be area wagera create hota hai likin wo fill howy bager move kardeta hai. Secondly ya ky ICT totally base he sirf Liquidity or Stop loss hunting py hai agr sary Reatil Trader ICT concepts ko use karky Trading karnny lgjay tou phir market me kis ky SL Hunt hogy or Liquidity create hogi jis ko ICT trader use karky apni Trade ko Execute karty hai.

SMC ho ICT ya Price Action, remember we can anticipate market move, we can not guarantee it will move like this.

So market hamary analysis ko follow karny ki bound ni ha na hi market ny har FVG/imbalance fill karna ha, we just see k konsy imbalance ya fvg ya order block main market ny kia reaction dia and according tothat hm apna decission lety hain.

2ndly ICT is not just about liquidity its basically time and price theory based on IPDA and still ICT traders lose too because even after mastering ICT we are still retail traders and we can just anticipate price move.

Sir ap ka bohat shukria ky ap ny mujhy reply keya or mery mind ky conepts ko clear keya.

No issue. You are welcome any time.

Hello sir

I like the way you teach.

Do you have any youtube channel so i can learn the videos

You can search @Tradetrack on youtube, I sometimes post videos there.

Sir, can you give a complete syllabus on ICT. So that we can complete the course step by step.

I will try soon. Working on that.