SIBI and BISI the ICT Concepts – All You Need to Know

Mastering all ICT concepts is essential for trading using the ICT strategy. Among these crucial concepts are SIBI and BISI, which play a significant role in the ICT trading strategy.

SIBI and BISI are basically types of ICT Fair Value Gap based on the price move (Bullish and Bearish).

This article aims to educate you comprehensively on SIBI and BISI, covering their definitions, formation, identification, and practical application through visual examples.

Now lets study each of them separately.

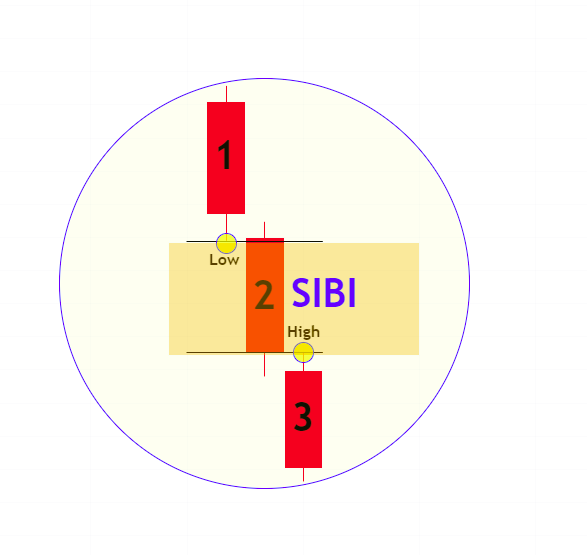

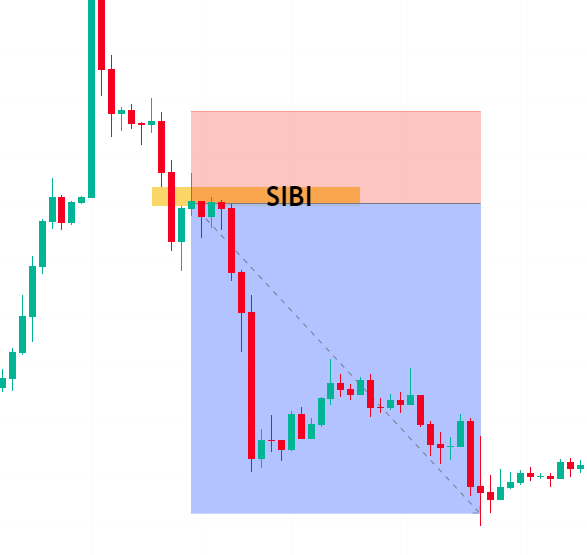

What is SIBI?

The word SIBI is abbreviation of Sell Side Imbalance Buy Side Inefficiency.

It is basically a bearish fair value gap followed by an impulsive downward price movement driven primarily by sellers with minimum buyers to counter it.

SIBI is a three candle formation with large bodies and minimal wicks indicating strong selling pressure.

The formation of three candles results in a gap between the low of the first candle and the high of the third candle.

This pattern highlights the dominance of sellers and the lack of effectiveness on the part of buyers, hence termed as SIBI (Sell Side Imbalance Buy Side Inefficiency).

How to Use SIBI in Trading?

Relying solely on SIBI for trading is not advisable.

To effectively utilize SIBI in trading, it should be aligned with other ICT concepts, such as ICT PD Array for a more comprehensive approach.

But SIBI may perform 3 main functions effectively.

(I) SIBI can be used in Execution of sell trade after the confirmation like market structure shift.

(II) SIBI can act as a Resistance and prevent price from moving up.

(III) SIBI may help you to Place Stop Loss. Mostly stop loss is placed above the high of SIBI (1st candle).

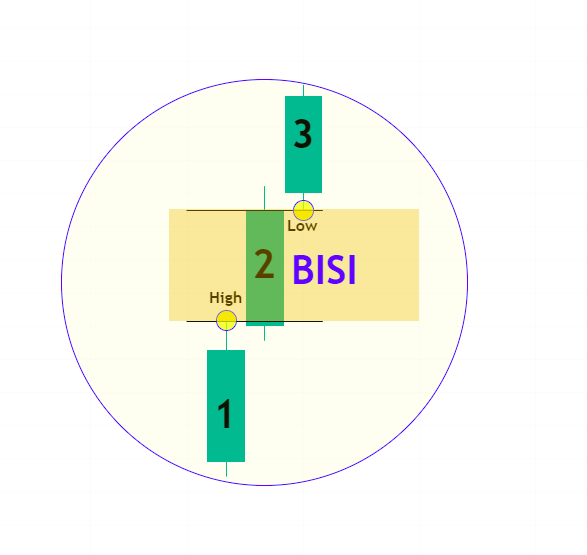

What is BISI?

The word BISI is abbreviation of Buy Side Imbalance Sell Side Inefficiency.

It is basically a bullish fair value gap followed by a strong upward price movement driven predominantly by buyers with minimum sellers to counter it.

BISI is a three candle formation with large bodies and minimal wicks indicating strong buying pressure.

The presence of three candles creates a gap between the high of the first candle and the low of the third candle.

This gap signifies the strength of buyers and the lack of efficiency among seller, hence referred to as BISI (Buy Side Imbalance Sell Side Inefficiency).

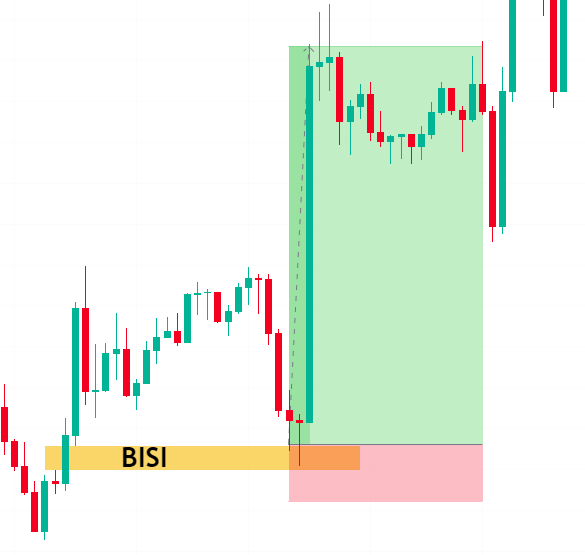

How to Use BISI in Trading?

You can’t rely on BISI solely.

For trading you may use BISI with other ICT concepts as a strategy to gain better results.

But BISI may perform following main functions effectively.

(I) BISI can be used in Execution of buy trade after the confirmation like market structure shift.

(II) BISI can act as a Support and prevent price from falling down.

(III) BISI may help you to Place Stop Loss. Mostly stop loss is placed below the low of BISI (1st candle).

Final Thoughts on SIBI and BISI

While trading using SIBI and BISI we should keep in mind that every SIBI and BISI in the market is not tradeable , to trade using SIBI and BISI, we should use it in conjugation with other strategies like demand & supply or support & resistance . At these levels SIBI and BISI can act as a more reliable tool to take a trade.

Plus to mitigate your risks, you should always trade with stop loss in place as no strategy is foolproof in trading.